Insurance Underwriting Software

The custom-made, comprehensive construction insurance underwriting system.

Customer

A leading West European insurance company that provides various insurance products to individuals and business customers. The area of business includes household and building insurance, private liability, travel and motor vehicle insurance, health and accident insurance, property and production loss insurance, technical insurance, construction and building insurance, vehicle, fleet and marine insurance, etc.

Challenge

The company was in the midst of significant business expansion in the area of construction insurance, that required integration of 13 separate client branches and an existing underwriting process designed in the company needed to be optimized in order to speed up the issuing of an insurance policies. The company also needed a solution that could be fully integrated into their corporate infrastructure.

Solution

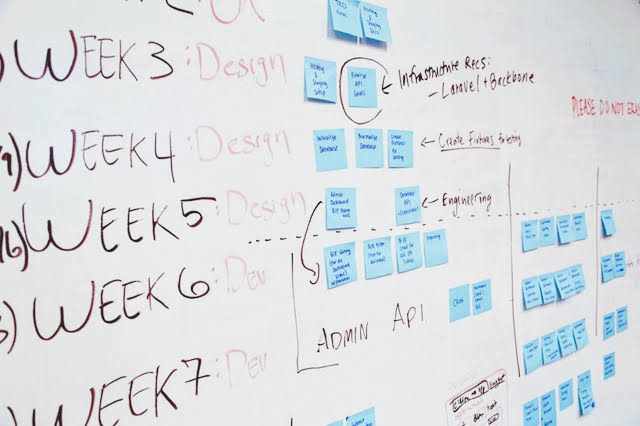

To help pace the work, our Business analysts developed Business requirements to guide the team in the work necessary to succeed. Gradually, with a series of Agile sprints our developers were delivering “proof of concept” components of the system. Embedding the quality assurance personnel helped to improve quality and success rates for delivered work.

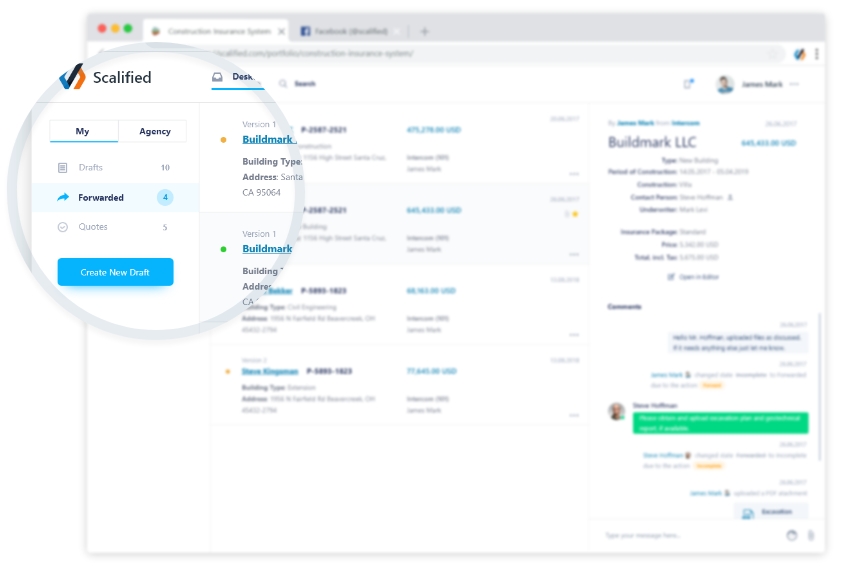

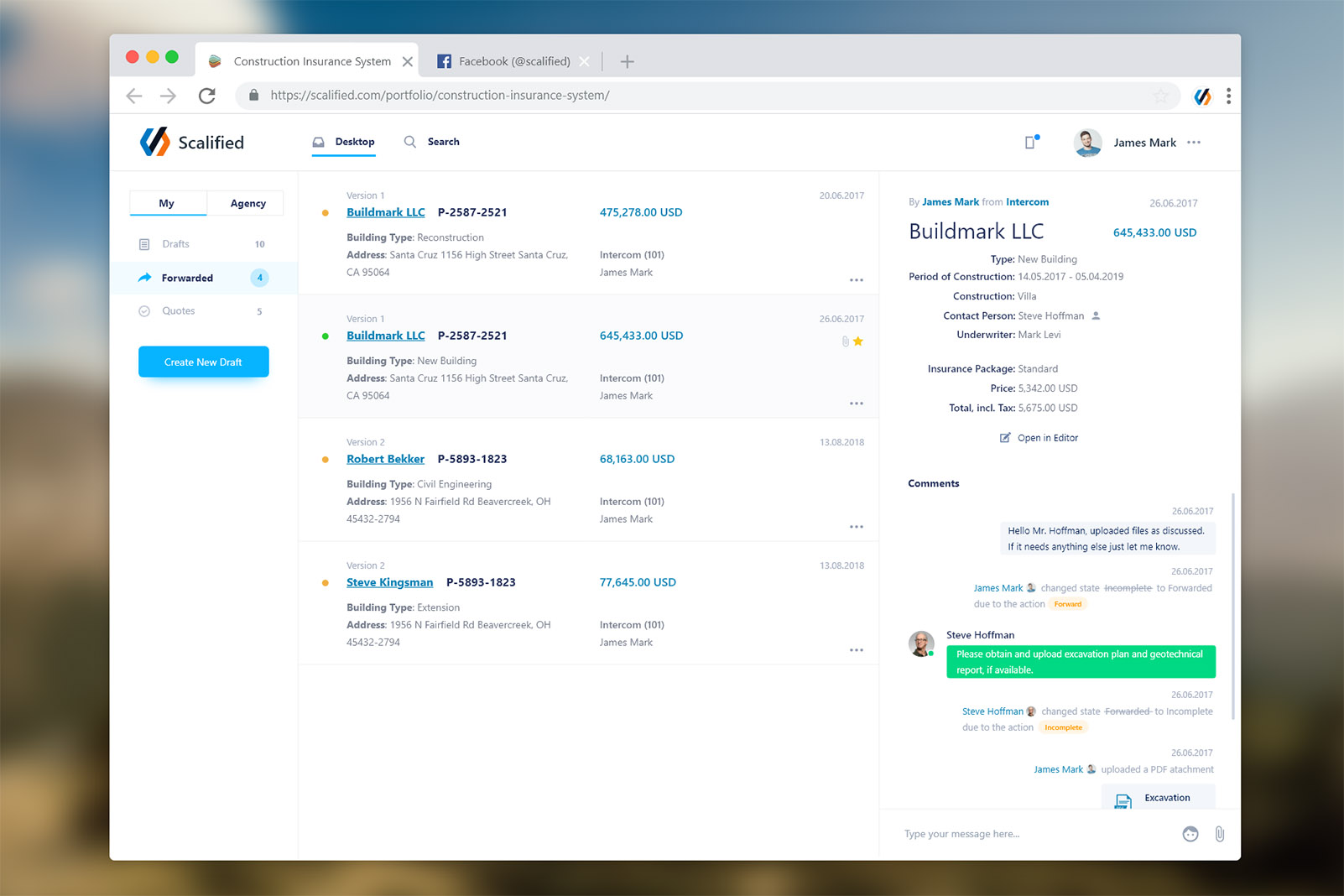

The implemented dashboards allowed underwriters and sales agents to access ongoing insurance quotes right from the single place. This increased their productivity up to 30%! The time for determining the issuing of an insurance policy reduced respectively.

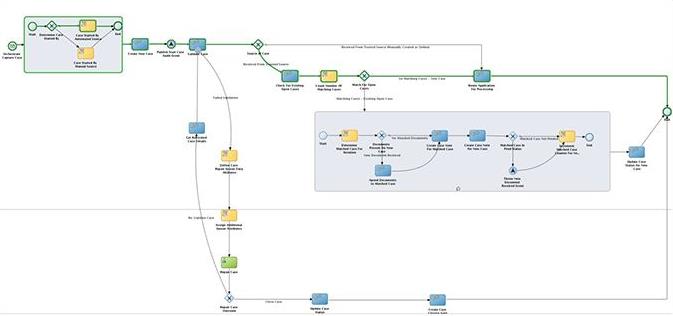

As a main requirement our team implemented a flexible workflow subsystem that allowed to configure the process for different types of insurance policy documents. Based upon the populated data (coverage, special conditions, etc.) the system could decide which workflow needs to be chosen and what risks must be checked by underwriters. This eliminated a human-factor during the process and therefore increased efficiency.

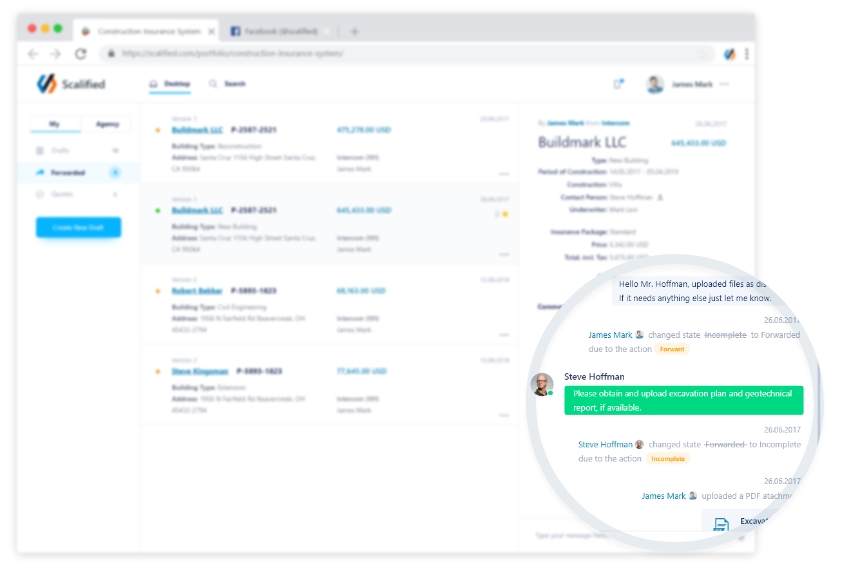

The communication between all involved parties during the insurance quote lifetime became very efficient after chat feature was introduced. Every chat room is focused on particular insurance document, with it’s isolated context and history of changes. The embedded chat-bots notify responsible employees about important events throughout the underwriting process.

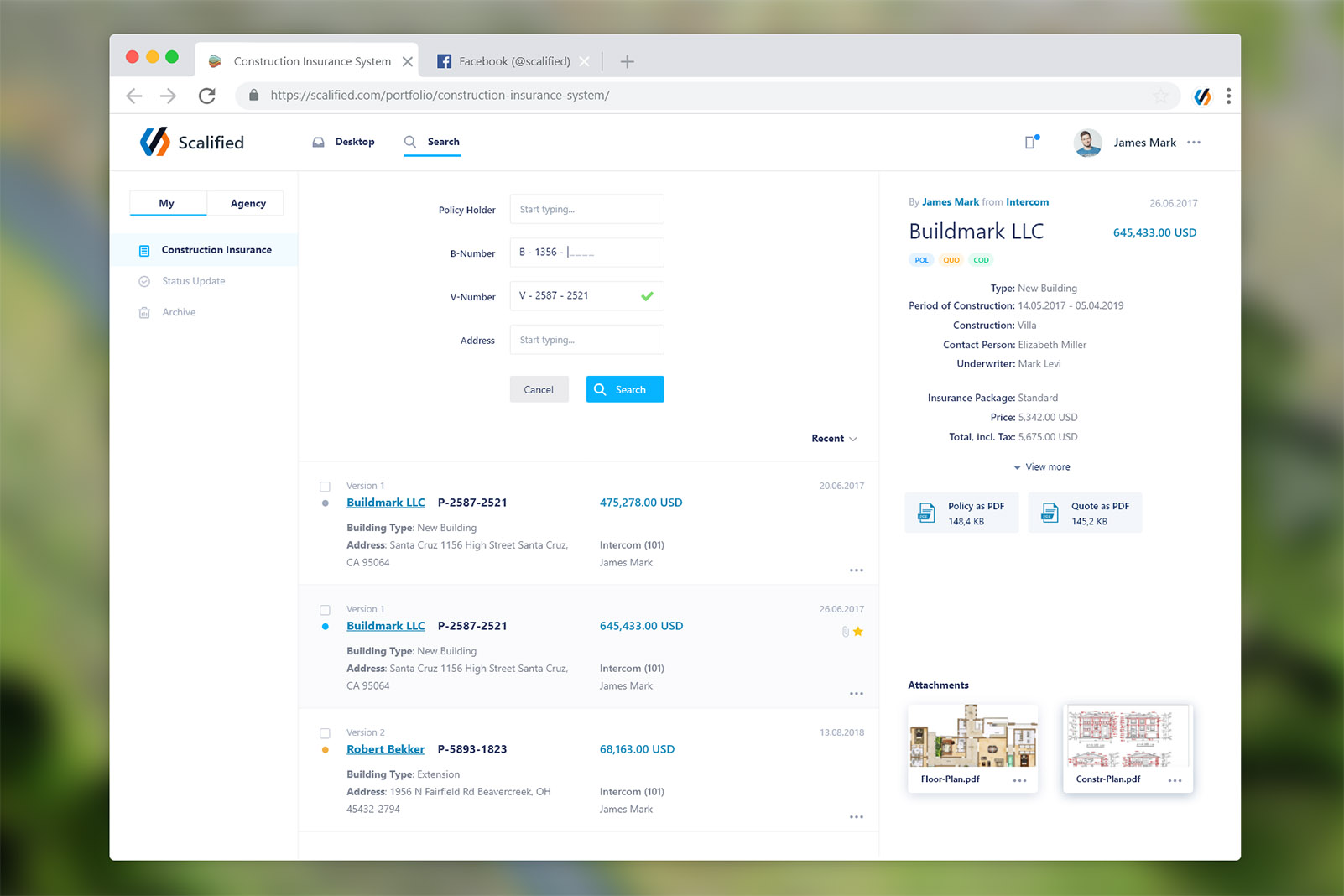

Effortlessly locate and manage insurance policies with the intuitive Construction Insurance System search form. Designed for speed and precision, this feature enables users to quickly access policy details, ensure accurate data retrieval, and streamline insurance operations. Perfect for underwriters, agents, and administrators alike.

Utilized Technologies

FAQs

Frequently Asked Questions

How did the implemented dashboards improve productivity?

The dashboards provided underwriters and sales agents with centralized access to ongoing insurance quotes, increasing their productivity by 30% and significantly reducing the time required to issue insurance policies.

What is the role of the flexible workflow subsystem in the underwriting process?

The workflow subsystem automates the process selection based on data like coverage and special conditions, ensuring appropriate risk checks and eliminating human error to improve efficiency.

How does the chat feature enhance communication during the underwriting process?

The chat feature creates isolated rooms for specific insurance documents, with change histories and context. Embedded chatbots notify relevant employees about critical events, ensuring seamless communication.

How did Agile development contribute to the project’s success?

Agile sprints allowed for iterative delivery of “proof of concept” components, enabling ongoing improvements. Quality assurance personnel embedded in the process ensured high-quality deliverables and minimized errors.

Contact us!

Do you have an idea for a website, online business, or application, but need a team to turn that idea into reality?