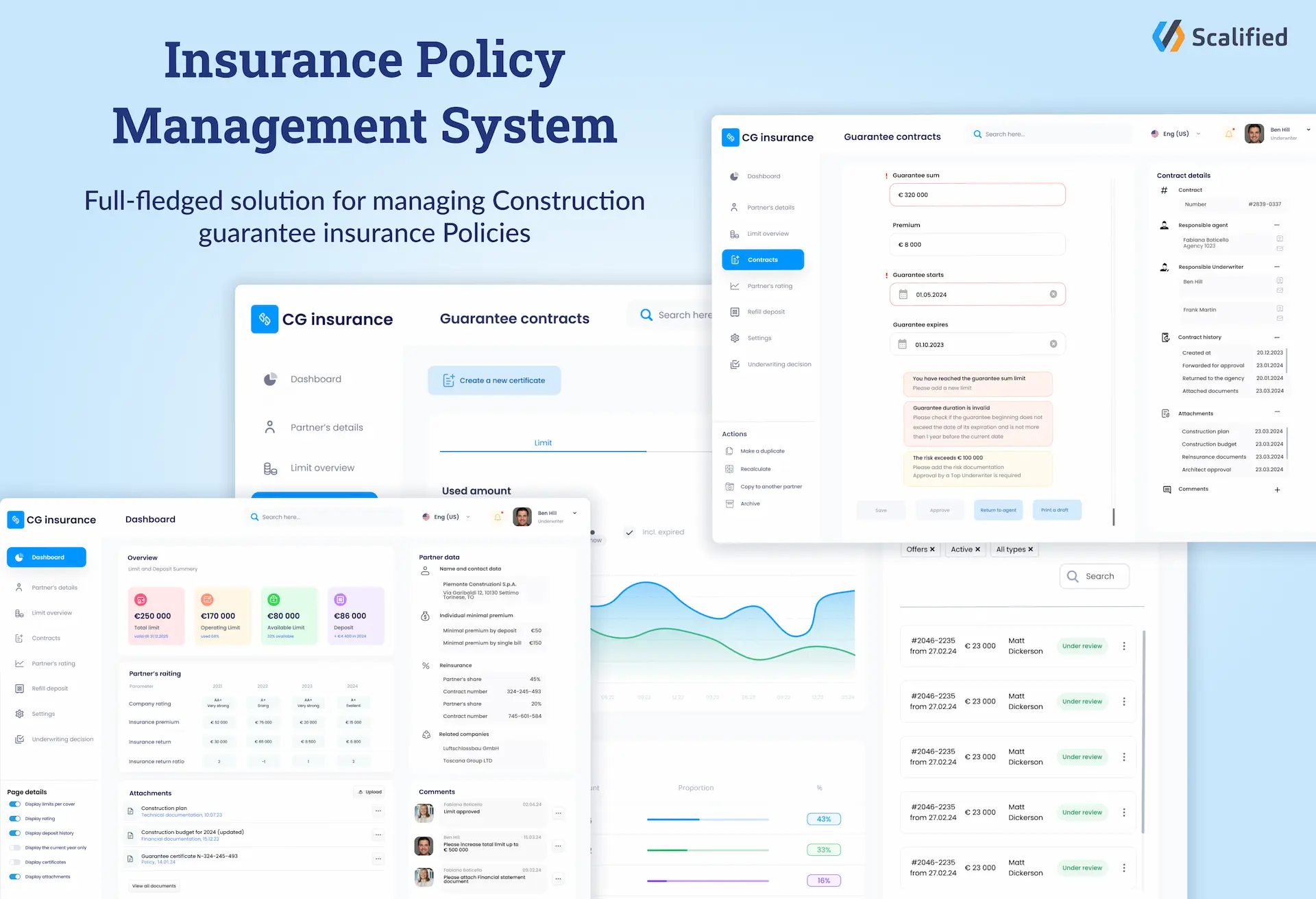

Construction Guarantee Insurance Policy Management System

Full-fledged solution for managing Construction guarantee insurance Policies from inception to termination.

It simplifies and streamlines the process of construction guarantee Policy preparations, tracking of guarantee Certificates and limits, managing claims, and keeping all stakeholders in the communication loop. The policy management system was designed specifically for the insurance agency's unique needs and challenges, ensuring perfect alignment with the agency’s business processes, operational models, and specific requirements.

Challenge

An insurance company specializing in Construction Guarantee Insurance encountered the limitations of outdated legacy systems. These legacy systems hindered operational efficiency due to manual processes and fragmented data storage. The company faced a challenge in automating routine tasks to reduce manual processing thus minimizing errors. Additionally, the absence of a centralized database made it difficult to maintain detailed records of Customer data, policy details, and communication touchpoints. Therefore, the company aimed to modernize its operations by implementing a centralized software solution that streamlines the company's processes, automates tasks, and ensures accurate data management.

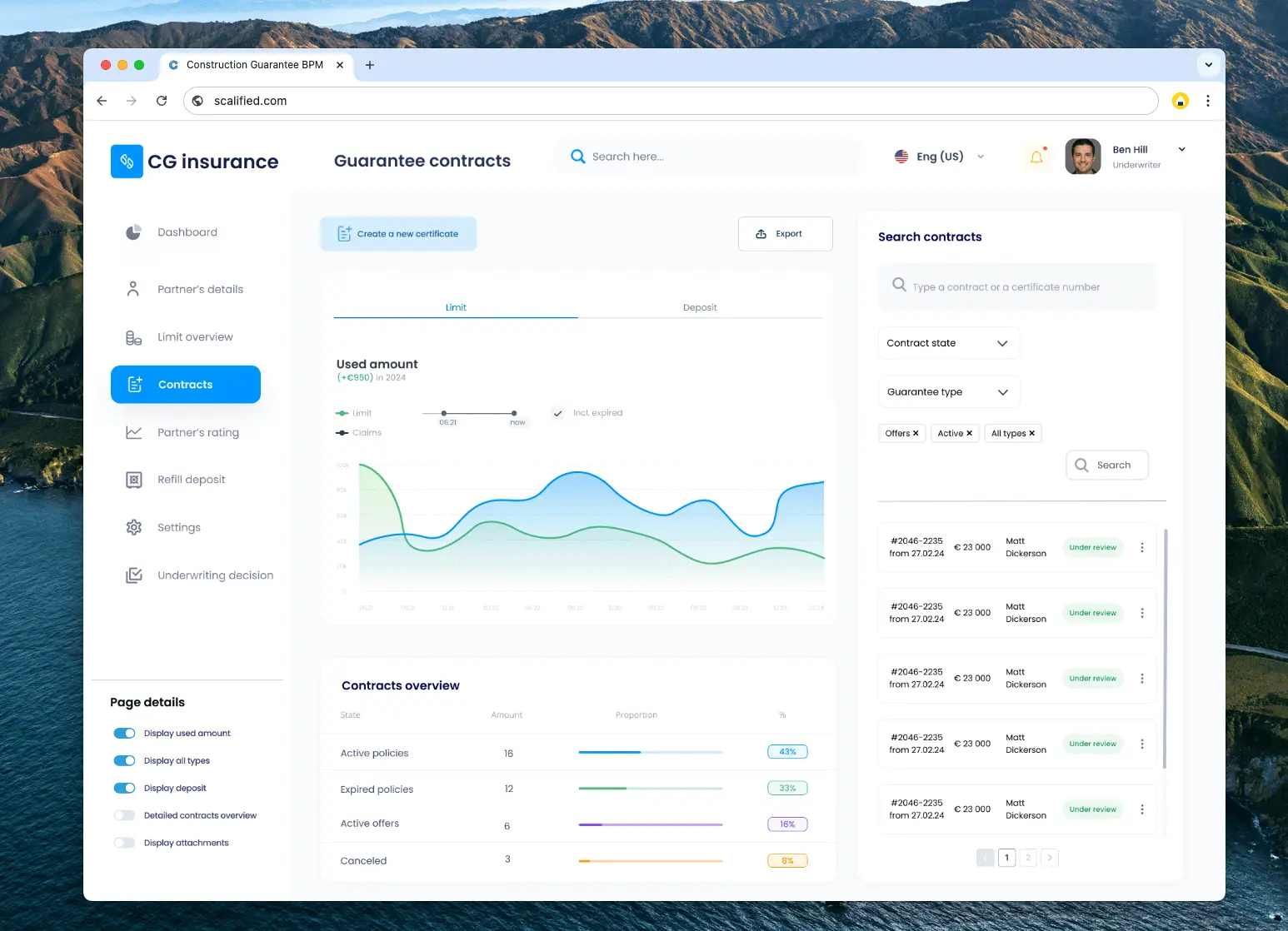

Data Visualization

Our solution incorporates a sophisticated data visualization feature designed to address the challenge of analyzing extensive datasets efficiently. By presenting insurance data sets graphically, our system facilitates clearer understanding, analysis, and decision-making for Underwriters. This enables them to assess risks more effectively, identify overexposures or underutilized coverage, and make informed underwriting decisions swiftly. Implemented data visualization capabilities empower insurers to evaluate policyholder risks with precision, enhancing their ability to make the right decisions and develop targeted risk management strategies.

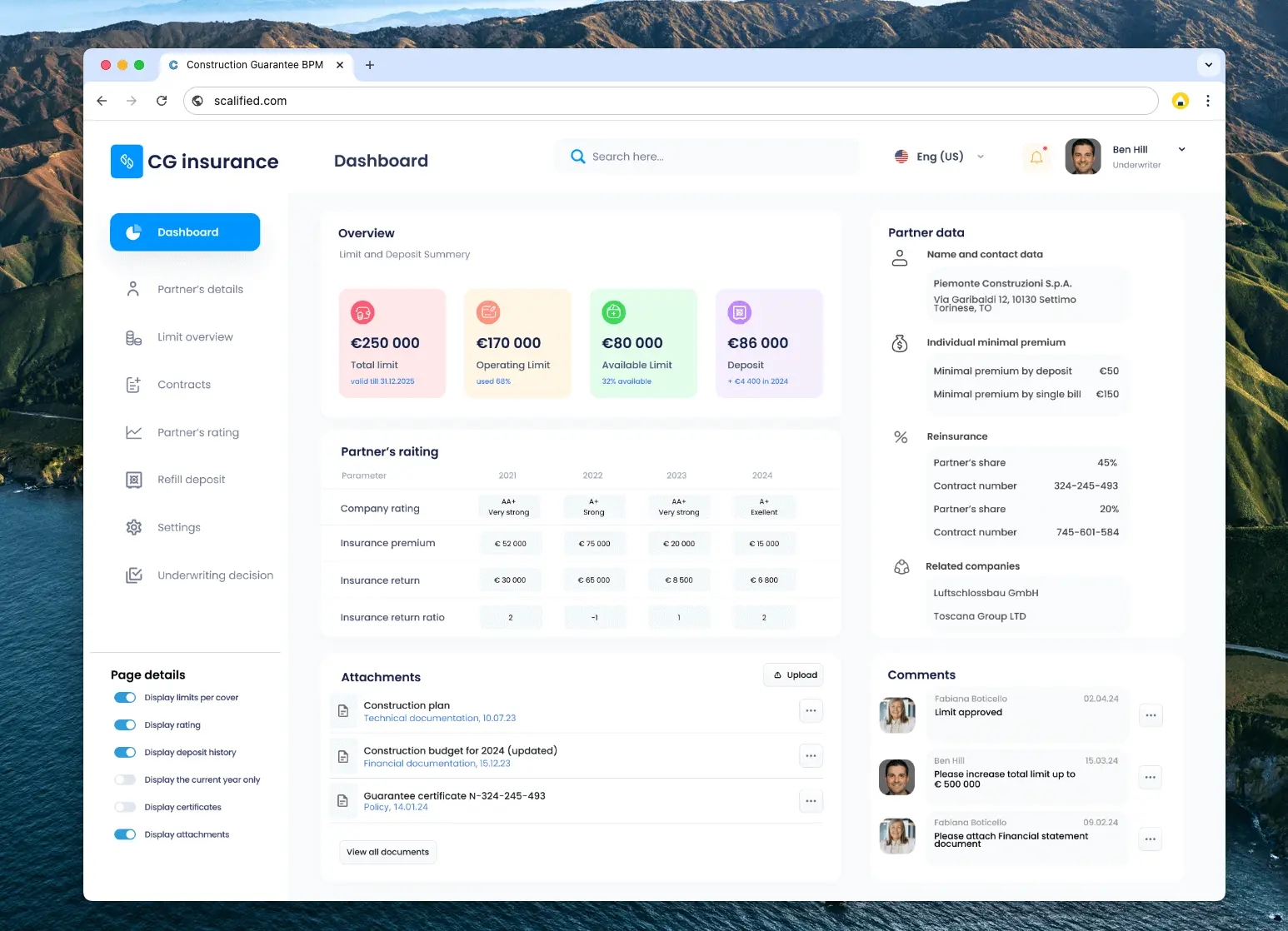

Extensive Data Management and Analysis

The process of creating policies requires the analysis of extensive and varied information, including customer ratings, project details, financial records, contractual agreements, and risk assessments. The implemented solution provides powerful features for managing all aspects of insurance policy processing. By consolidating customer information into one place, insurers can efficiently collect, organize, and access data. This streamlines the policy creation process, enabling informed underwriting decisions and accurate policy generation, ultimately improving operational efficiency and customer satisfaction.

Risk Management

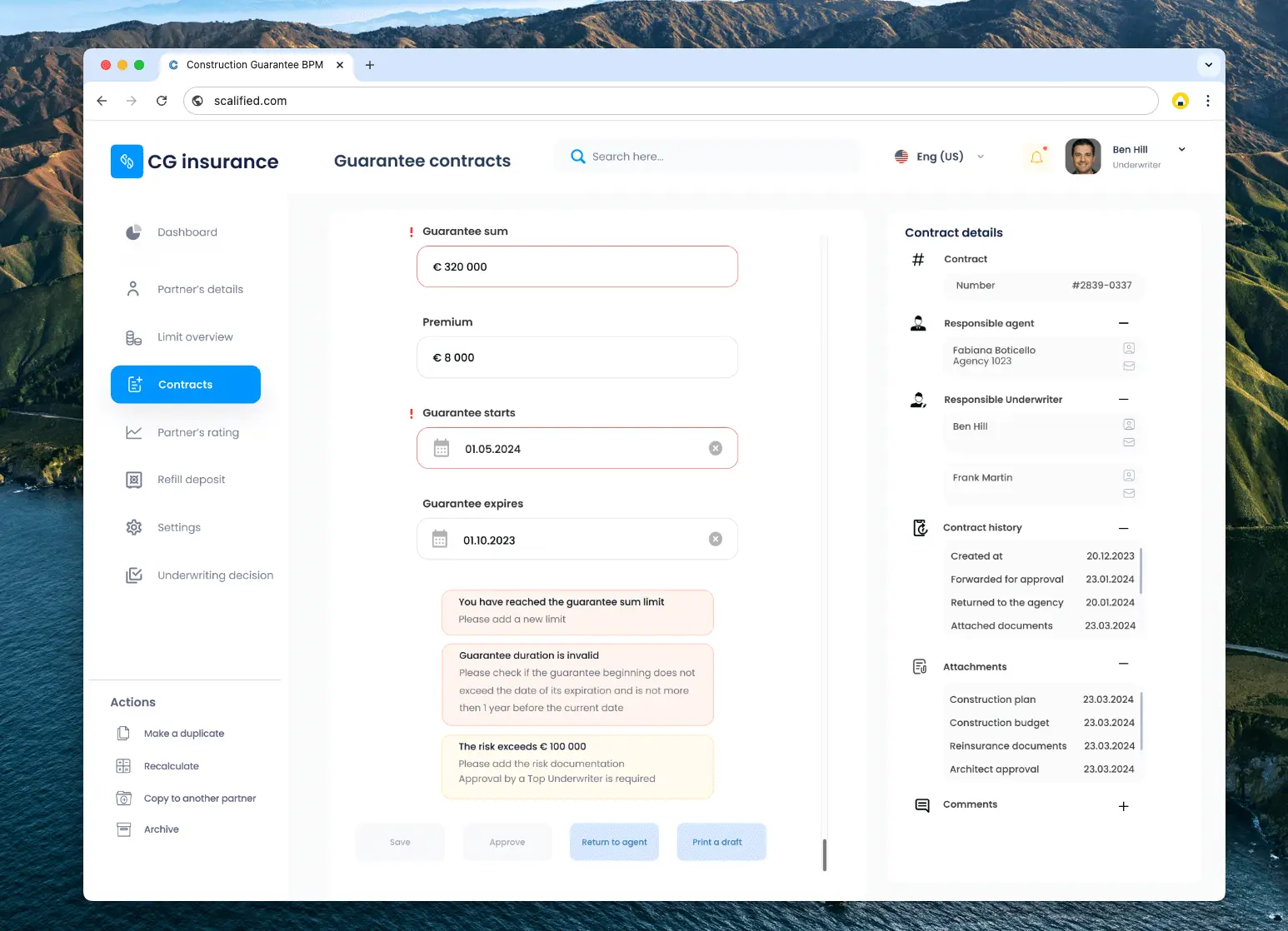

After delivering the implemented system, the risk management process became seamless and efficient. It helped to apply the company's designated criteria to process operational data, swiftly identifying potential risks. With implemented business rules and role-based permissions , insurance agents can autonomously handle contract data or escalate it to underwriters for further evaluation and modifications that make the risk acceptable.

Agents obtained the flexibility to accept contract data independently or seek guidance from underwriters. This streamlined and automated process accelerates the initial review of insurance applications and supporting documents, enabling insurance companies to make informed decisions quickly and accurately. By replacing outdated spreadsheets and manual processes, the system mitigated organizational fragmentation and enhanced the accuracy of risk data and risk management processes.

Communication Empowering

By facilitating seamless communication between agents, underwriters, and other interested parties, the delivered solution enhanced the efficiency and effectiveness of the insurance policy creation process. A centralized platform for communication enabled agents and underwriters to collaborate effectively throughout the insurance policy's lifetime. The integrated feature of a dedicated chat room provides an isolated context for every specific insurance project and its history of changes for easy reference. Moreover, integrated chatbots notify responsible employees about important events during the construction guarantee policy lifecycle, ensuring timely responses and actions. This proactive approach to communication enhances operational efficiency and reduces the risk of delays or oversights.

FAQs

Frequently Asked Questions

Are there tools to set reminders or automated workflows for policy renewals and terminations?

Yes, our platform provides tools for setting reminders for policy renewals and terminations. Specifically, it includes an automated email notification system that sends reminders a few weeks before a policy expires. This ensures timely action and helps prevent missed renewals or terminations. The feature is simple to set up and keeps both agents and clients informed, improving overall efficiency and customer satisfaction.

Is there an audit trail feature to monitor who made changes to policies and when?

Yes, our platform includes an audit trail feature to monitor who made changes to policies and when. The workflow transition history records every action taken, along with the responsible user's details and timestamps. For high-risk contracts, the system also sends email notifications to the assigned underwriter for specific actions. This ensures transparency, accountability, and timely communication, helping to manage policies efficiently and securely.

How does your data visualisation tool work, and what kinds of insights can it provide?

Our data visualization tool makes analyzing insurance data and supporting risk-based decision-making easy and intuitive. It allows users to represent data graphically, showing dependencies between various parameters like limit, used and available guarantee amount, premium, and validity period, etc. Users can customize graphs by selecting parameters, scaling as needed, and adjusting dependencies to suit their analysis.

How does the system facilitate collaboration between agents, underwriters, and clients?

Our system facilitates seamless collaboration between agents, underwriters, and clients through several key features. For agents and underwriters, it offers a flexible workflow configuration and dedicated dashboards displaying limits or certificates in various states, ensuring clear visibility and efficient task management. The integrated mail notification system keeps all parties informed about workflow actions, while a comment feature enables real-time communication and feedback. For clients, the system provides automated email notifications to keep them updated on policy progress and key milestones.

Contact us!

Do you have an idea for a website, online business, or application, but need a team to turn that idea into reality?